This month, volatility in the currency market fell to its lowest level in five years. In times like this, many analysts argue that big moves are on the horizon but it could be upwards of a year before that happens.

The last time FX volatility was this low was in June 2014 and at that time there were about 10 months of consolidation before a major breakout. In 2007, the low-volatility environment persisted for about a year and prior to that, the most pronounced period of low volatility was in 1996 and the consolidation also lasted about a year. We’re currently three months into this market environment, which means it could be another six to nine months before volatility explodes. This makes sense because most, if not all, major central banks have no plans to change monetary policy again in 2019 and the lack of potential policy surprises minimizes the impact of incoming data and the general moves in currencies. Also, the steady gains in stocks keep investors complacent.

Volatility will return when stocks crash because a sharp sell-off would be a tipping point that triggers widespread profit taking and broad-based risk aversion – we got a taste of that in December and January. The only question is what could cause this turn in sentiment? We know that central bankers are worried about global growth but the moves in equities fail to recognize these concerns. Stocks could peak if US-China trade talks turn south or the EU-US trade war heats up. If earnings are weak or data stabilizes enough for central banks to reconsider tightening, rate-hike talk could also drive stocks lower. Sometimes stocks correct for no reason at all – they sell-off sharply one day and the fear of further losses drives them even lower. Regardless, it may be some time before the selling begins so for now, it is best to focus on strategies that thrive in low volatility markets. This means fading tops and bottoms, being nimble with profit targets and taking your cue from stocks and yields. Also, don’t expect big reactions to major economic reports.

US Dollar

Data Review

- Fed Beige Book – A few districts reported some strengthening in activity. Economic activity grew at a slight to modest pace

- Empire State 10.1 vs. 8 Expected

- Industrial Production -0.1% vs. 0.2% Expected

- NAHB Housing Index 63 vs. 63 Expected

- Trade Balance -$49.4B vs. -$53.4B

- Retail Sales 1.6% vs. 1% Expected

- Retail Sales ex Auto & Gas 0.9% vs. 0.4% Expected

- Philadelphia Fed Index 8.5 vs. 11 Expected

- Jobless claims fall to 50 year low

- Housing Starts 1139K vs. 1228K Expected

- Building Permits 1269K vs. 1300K Expected

Data Preview

- Existing and new home sales – Paring expected after strong rise in February

- Durable goods orders – Rebound expected given recovery in trade

- Q1 GDP – Potential upside surprise given stronger trade balance and retail sales first three months of the year

- University of Michigan Consumer Sentiment Index – Potential upward revision given strength in spending, jobless claims and equity market strength

Key Levels

- Support 111.00

- Resistance 113.00

Dollar Is Bid But Not Against The Yen

There’s no doubt that 112 is an important level for USD/JPY. The pair hovered a few pips underneath this level all of last week in the narrowest trading range that we’ve seen in years. USD/JPY should be trading much higher given that the Dow Jones Industrial Average ended the week at its strongest level since October. US data was also better than expected with retail sales rising by its strongest level since September 2017 and jobless claims falling to a 50-year low. With wages on the rise and stocks performing well, US consumers returned with a vengeance after the government shutdown. The low level of jobless claims reflects a tight labor market that should support consumer spending going forward. However, USD/JPY barely budged because investors do not believe that one month of strong data will sway the central bank’s outlook. Most policymakers have recognized the robustness of the labor market and the potential recovery in spending. Their main concerns are growth abroad and trade – two issues that continue to pose serious risks to the US and global economy.

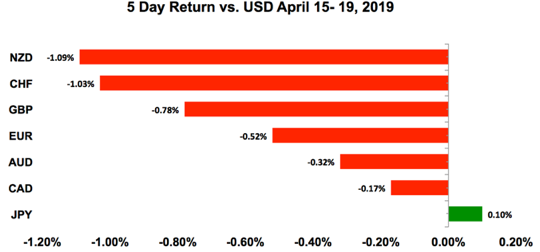

USD/JPY is not always the best barometer for the market’s appetite for US dollars. The greenback actually traded higher against all of the other major currencies last week and with stocks rising, the move was not driven by risk aversion. The worst-performing currency was the New Zealand dollar, which fell hard after weaker CPI. The most resilient was the Canadian dollar, which benefited from strong trade and retail sales numbers. Looking ahead, while USD/JPY is prime for a breakout, we don’t expect that to happen this week because most markets are closed for Easter Monday and there are very few market-moving US economic reports on the calendar. The only number worth watching will be Friday’s first quarter GDP.

AUD, NZD, CAD

Data Review

Australia

- RBA considering scenarios under which rate cut would be necessary

- Employment Change 25.7K vs. 15K Expected

- Unemployment Rate 5% vs. 5% Expected

- Full Time Employment 48.3K vs. -1.7K Previous

- NAB Business Confidence -1 vs. 1 Previous

New Zealand

- PMI Services 52.9 vs. 53.6 Previous

- CPI 0.3% vs. 0.1% Expected

Canada

- Existing Home Sales 0.9% vs. 2% Expected

- Manufacturing sales -0.2% vs. -0.1% Expected

- Trade Balance -2.9B vs. -3.25B Expected

- CPI 0.7% vs. 0.7% Expected

- Retail Sales 0.8% vs. 0.4% Expected

Data Preview

Australia

- CPI – Potential downside surprise because commodity prices were on the rise but consumer inflation expectations eased

- PPI – Will have to see how CPI fares but PPI should be a bit higher

New Zealand

- NZ Trade Balance – Likely to be weaker given decline in manufacturing activity

Canada

- Bank of Canada widely expected to keep interest rates unchanged. Will be interesting to see if they recognize recent data improvements.

Key Levels

- Support AUD .7100 NZD .6650 CAD 1.3300

- Resistance AUD .7200 NZD .6800 CAD 1.3400

Bank Of Canada Rate Decision – Biggest Event Risk Of The Week

Better-than-expected economic reports from Australia and Canada failed to help the AUD and CAD, whereas weakness in New Zealand exacerbated the slide for the NZD. All three of the commodity currencies lost value against the greenback with NZD falling to its lowest level in three months as softer CPI growth hardened the case for a rate cut by the RBNZ. There was also a big divergence with the performance of AUD, which hit a one-month high last week. Australian labor market data was significantly better than expected with the economy adding rather than shedding full-time jobs. Unfortunately, even with this improvement, the Reserve Bank feels that “forward indicators of labor demand” were mixed and a discussion of the scenarios where a rate cut may be appropriate was necessary. The mere talk of rate cuts diminishes the impact of positive data. AUD and NZD also shrugged off strong data out of China last week. Their massive stimulus package is finally working with consumer spending and manufacturing activity rebounding strongly in March, but it is far too early to declare a bottom, especially when US-China trade talks are not complete. On a fundamental and technical basis, AUD and NZD are vulnerable to further weakness particularly since this week’s Australia CPI and New Zealand trade numbers could miss expectations but US and China trade talks have reached a turning point and there’s a good chance that a signing summit could be scheduled for May. If that’s true, it would be wildly positive for AUD and NZD.

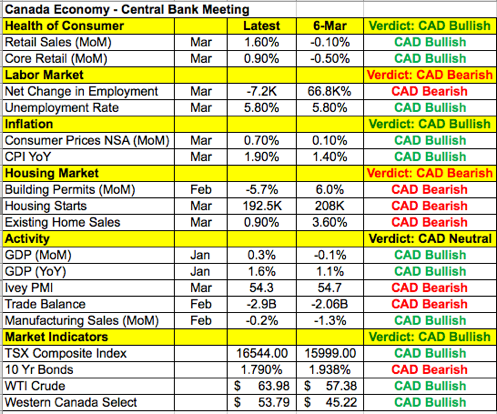

The biggest event risk of the week will be Wednesday’s Bank of Canada monetary policy announcement. In March, the BoC sent USD/CAD tumbling to two-month lows by expressing concerns about growth, pointing to increased uncertainty on the timing of future rate hikes. At the time, it was worried about consumer spending, housing and inflation. Fast forward seven weeks and some of those concerns will be alleviated by the recovery in retail sales and uptick in CPI growth. Unfortunately, that may not be enough to alter the central bank’s dovish bias. USD/CAD has been trading in a narrow 1.3290 to 1.3400 trading range since the beginning of the month and if the BoC ignores all of the recent data improvements and reiterates their concerns about the economy, we could see USD/CAD squeeze toward its March high of 1.3470.

British Pound

Data Review

- Rightmove House Prices 1.1% vs. 0.4% Previous

- Jobless Claims 28.3K vs. 26.7K Previous

- Average Weekly Earnings 3.5% vs. 3.5% Expected

- ILO Unemployment Rate 3.9% vs. 3.9% Expected

- UK CPI 0.2% vs. 0.2% Expected

- UK CPI YoY 1.9% vs. 2% Expected

- PPI Input -0.2% vs. 0.3% Expected

- PPI Output 0.3% vs. 0.2% Expected

- Retail Sales 1.1% vs. -0.3% Expected

- Retail Sales ex Auto 1.2% vs. -0.3% Expected

Data Preview

- No Data

Key Levels

- Support 1.2800

- Resistance 1.3100

GBP Shrugs Off Good Data

The sell-off in sterling last week was surprising considering the good employment and retail sales reports. Employment rose to a new record high as wage growth held steady at 3.5%. The ILO unemployment remained at its lowest level in nearly 45 years, providing the perfect backdrop for spending. The latest retail sales report shows that UK consumers were unfazed by Brexit uncertainty in March. Consumer spending rose 1.1% against a forecast for -0.3%. Economists were bracing for a contraction, but strong online sales drove retail sales higher for the third month in a row. These reports should have been positive for sterling, but the currency drifted quietly lower. Softer inflation numbers could be a factor but the primary reason for the currency’s weakness is that at the end of the day, investors don’t expect these latest reports to affect the Bank of England’s outlook. It has no plans to raise interest rates until Britain decides on the terms of leaving the European Union. The extension of Article 50 prolongs this uncertainty and delays the timing for tightening. There are no major UK economic reports scheduled for release this week so it should be a quiet week for GBP. With that in mind, GBP/USD has strong support near 1.2650.

Euro

Data Review

- German ZEW Current 5.5 vs. 8.5 Expected

- German ZEW Expectations 3.1 vs. 0.5 Expected

- EZ ZEW 4.5 vs. -2.5 Previous

- EZ Trade Balance 19.5B vs. 17B Previous

- EZ PMI Composite 51.3 vs. 51.8 Expected

- EZ PMI Manufacturing 47.8 vs. 48 Expected

- EZ PMI Services 52.5 vs. 53.1 Expected

- German PPI -0.1 vs. 0.2% Expected

- German PPI YoY 2.4% vs. 2.7% Expected

- German PMI Manufacturing 44.5 vs. 45 Expected

- German PMI Services 55.6 vs. 55 Expected

- German PMI Composite 52.1 vs. 51.7 Expected

Data Preview

- German IFO – Mixed PMIs and ZEW means business sentiment probably won’t change much

Key Levels

- Support 1.1150

- Resistance 1.1350

Euro Is In Trouble

On a fundamental basis, there is very little reason to be bullish about euros. The economy is weakening, earlier this month German Bundesbank President Jens Weidmann warned that growth in the Eurozone’s largest economy could slow materially in 2019, the US is threatening the EU with hefty tariffs and the German–US 10-year yield spread is falling deeper into negative territory. Even though the ZEW surveyed showed concerns about the region’s outlook fading, softer German industrial production leaves them worried about current conditions. The EZ flash PMI readings – the absolute latest measure of conditions on the ground – also came in at 47.8 versus 48.1 dropping further into contractionary territory. According to Markit, “Backlogs of work dropped for the fourth time in the past five months and have not shown any growth since last November.

The reduction in backlogs was only fractionally smaller than in March, which had seen the steepest decline since December 2014.” The only saving grace from the report was rebound in German services PMI, which helped offset some of the weakness in manufacturing. Still, Germany, which is the core of the European economy, remains highly vulnerable to manufacturing slowdown which itself is roiled not only by cyclical but secular factors.

A massive part of German economy – and European manufacturing sector as well is dependent on car production, which is going through wrenching changes and existential threat from electric vehicles. But it’s difficult to imagine that Europe will see any rebound in manufacturing any time soon and the region’s best hope for growth remains in services where the demand appears to be more stable and stronger. The German IFO is scheduled for release this week and we are not looking for any material improvement in business confidence.

Technically, EUR/USD’s rejection of 1.13 followed by lower highs and lower lows is a sign of weakness and the pair’s failure to close above the 50-day SMA signals a potential move below 1.12.

About Author: Kathy Lien

Having graduated New York University’s Stern School of Business at the age of 18, Ms. Kathy Lien has more than 13 years of experience in the financial markets with a specific focus on currencies. Her career started at JPMorgan Chase where she worked on the interbank FX trading desk making markets in foreign exchange and later in the cross markets proprietary trading group where she traded FX spot, options, interest rate derivatives, bonds, equities, and futures.

In 2003, Kathy joined FXCM and started DailyFX.com, a leading online foreign exchange research portal. As Chief Strategist, she managed a team of analysts dedicated to providing research and commentary on the foreign exchange market. In 2008, Kathy joined Global Futures & Forex Ltd as Director of Currency Research where she provided research and analysis to clients and managed a global foreign exchange analysis team. As an expert on G20 currencies, Kathy is often quoted in the Wall Street Journal, Reuters, Bloomberg, Marketwatch, Associated Press, AAP, UK Telegraph, Sydney Morning Herald and other leading news publications. She also appears regularly on CNBC – US, Asia and Europe and on Sky Business.

Kathy is an internationally published author of the best selling book Day Trading and Swing Trading the Currency Market as well as The Little Book of Currency Trading and Millionaire Traders: How Everyday People Beat Wall Street at its Own Game – all published through Wiley. Kathy’s extensive experience in developing trading strategies using cross markets analysis and her edge in predicting economic surprises serve key components of BK Asset Management’s trading and money management techniques.

Get Kathy’s Free EURO Trading report at http://Investing.com.